Master Your Business Expenses & Reimbursements with ease

Description: Keep your expenses and reimbursements in check with an easy-to-use tool that simplifies your business finances.

Best Expense Tracking and Reimbursement App for Small Business

No matter the size—small, medium, or large—businesses of all kinds need reliable apps to track expenses.

On average, businesses allocate 20-30% of their total budget to fixed costs like rent, utilities, and office furniture, while variable costs like marketing, inventory, and employee wages can account for another 40-50% of expenses. Tracking these costs is not just important but essential to avoid overspending and ensure financial stability.

However, 64% of small businesses report struggling with cash flow issues, often due to poor expense management. Many organizations either choose tools that lack critical features or fail to understand what makes an expense tracker effective for their needs. Let’s have a look on best expense tracking and reimbursement app for small Business in 2025.

Why Are Business Expense Tracking Apps Essential in 2025?

Expense tracker software offers several advantages beyond just replacing pen and paper. One standout benefit is that these tools can help businesses save 15-20% on costs, as reported by various sources. These apps are designed with user-friendly interfaces, provide access from anywhere at any time, and automate tasks like receipt scanning. They also streamline the process of entering expenses and minimize errors, making expense management much more efficient.

Understanding the expense tracking and reimbursement app for small business

When choosing business expense-tracking tools, especially for small businesses, it’s essential to identify your needs to find the best solution. Since every organization has unique requirements, understanding the features that align with your business goals is key. Here are the top features to look for in an expense tracker:

Income and Expense Tracking

The primary purpose of an expense tracker is to monitor your income and expenses. It should allow you to import expenses directly from bank accounts, wallets, or credit cards. Without this functionality, an expense tracker would lose its core value.

Receipt Management

Your app should help organize receipts by capturing them during transactions. Features like categorizing receipts and storing them digitally are must-haves for efficient management.

Tax Management

A good expense tracker should simplify tax organization. Look for tools that automatically categorize tax-deductible expenses, providing a clear view of valid deductions and helping you avoid potential tax errors.

Invoice and Payment Management

Expense tracking software should integrate with debit and credit cards, net banking, and other payment options to track invoices. It should also send payment reminders to help you avoid late fees and save costs.

Report Generation

Expense tracking software should integratThe ability to generate detailed reports, such as profit and loss statements, income summaries, and balance sheets, is essential. Customizable reports help identify business trends, create budgets, and manage inventory effectively.

e with debit and credit cards, net banking, and other payment options to track invoices. It should also send payment reminders to help you avoid late fees and save costs.

Sales Tracking

For small businesses, expense trackers that double as sales management tools are highly beneficial. Features like credit card integration and compatibility with e-commerce platforms streamline expense tracking and sales reporting.

Vendor and Contractor Management

Many expense tracking apps allow you to manage vendors and contractors. The app should let you add, categorize, and organize vendors for smoother operations.

Secure Access

Security is crucial. Choose an app that allows restricted access to sensitive data, such as granting permissions to accountants or employees for specific tasks. This reduces errors and improves cost efficiency.

Project and Inventory Tracking

A great expense tracker also includes project and inventory management. It should let you monitor spending on goods and services, manage vendors, and even create purchase orders directly within the app.

Analytics and Insights

Advanced analytics with easy-to-understand charts and graphs help in making informed financial decisions. Look for tools that offer in-depth analysis to identify spending patterns and optimize resources.

Workflow Automation

Automation features, such as reminders for payments and follow-ups with vendors, save time and improve cash flow. This reduces the manual effort required to track transactions and ensures better relationships with clients and suppliers.

What is expense tracking and reimbursement app?

Tracking business expenses involve keeping a record of your company’s spending, including bills, fees, and other costs. One major benefit of tracking these expenses is identifying tax-deductible items, which can help reduce your tax burden. Additionally, it allows you to manage your budget effectively and assess your business’s profitability.

While manual tracking is an option, using business expense tracking apps eliminates the hassle of dealing with excessive paperwork and simplifies the entire process.

Recommended Reading: Expense Tracking Software: Complete Overview for 2025

Top 20 Best expense tracking and reimbursement app for small business in 2025

Managing expenses is a crucial aspect of running a business, no matter the size. From tracking income and payments to handling receipts and generating reports, having the right tools can make a world of difference in streamlining operations and ensuring accurate financial management.

To help you navigate the world of expense tracking, we’ve compiled a list of the 20 best expense tracking software for 2025. These tools will empower you to track business expenses, gain insights into your finances, and optimize your overall accounting processes.

1. Expense Tracker 365

_Uz9SZfkEec.png)

Expense Tracker 365 is an all-in-one expense management tool that helps you stay organized and ensure financial clarity. It automatically categorizes expenses, tracks income in real-time, receipt scanning and supports multiple currencies for global businesses. Its integration with other financial tools makes it perfect for both small businesses and larger teams.

- Pros: Easy to use, multi-currency support, seamless integrations.

- Cons: Limited customization in lower tier plans.

- Free Trial: 14 days

- User Rating: 4.8/5

2. Desk Track

Desk Track combines time tracking and expense management for a comprehensive solution. It offers project management, employee monitoring, and productivity tracking in addition to expense tracking. This is a great option for businesses that need more than just basic expense reporting.

- Pros: Real-time insights, automated billing, customizable reporting.

- Cons: Can be complex for new users.

- Free Trial: 15 days

- User Rating: 5/5

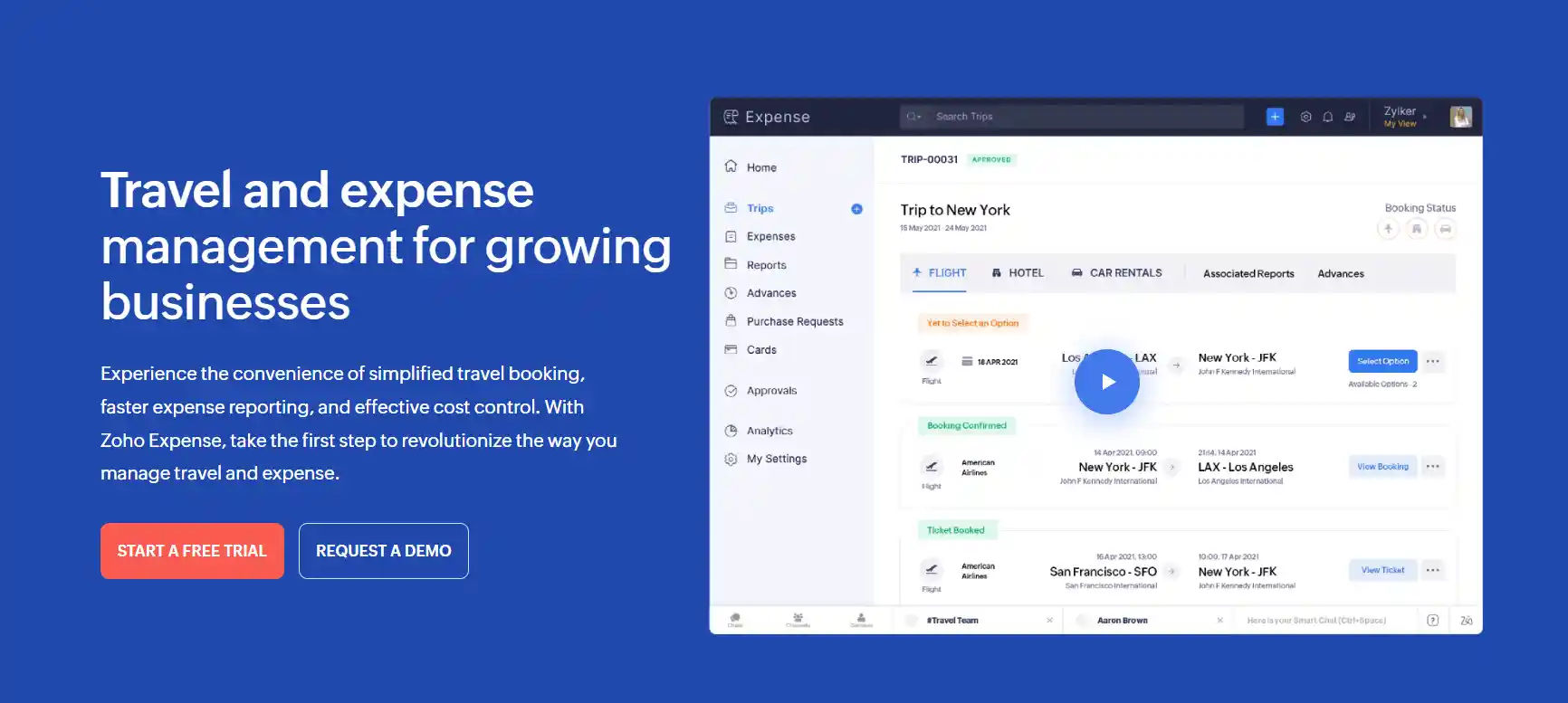

3. Zoho Expense

Zoho Expense is designed to help businesses of all sizes keep their expenses in check. With features like automated expense reporting and easy receipt scanning, it’s a solid choice for teams who need a simple yet effective expense tracking solution. The free plan also makes it accessible for small businesses.

- Pros: Free plan, easy to use, integrates with major accounting solutions.

- Cons: Limited receipts per expense on the free plan

- Free Trial: 14 days

- User Rating: 4.9/5

4. Rydoo

Rydoo is known for its simplicity and automation. It allows businesses to track expenses in real-time and provides automated approval workflows. The app’s ability to deny or approve expenses based on preset rules makes it a strong choice for expense management.

- Pros: Automated approval flows, real-time tracking, optimizes reimbursement cycles.

- Cons: Limited to 15 pages per receipt, scanning inaccuracies

- Free Trial: 14 days

- User Rating: 4.8/5

5. Imburse Certify

Imburse Certify stands out with its mileage tracking feature, which is excellent for businesses with frequent travel. It also offers automated report creation and receipt scanning, although it lacks workflow management tools.

- Pros: Multi-language and currency support, unlimited cloud storage

- Cons: No workflow management, no free version

- Free Trial: 14 days

- User Rating: 4.7/5

6. QuickBooks Online

QuickBooks Online is a household name when it comes to accounting and expense tracking. Its robust features like automated expense imports from bank accounts and credit cards make it ideal for small to medium-sized businesses.

- Pros: Comprehensive accounting, automated recurring expenses

- Cons: Reimbursement through payroll only

- Free Trial: 30 days

- User Rating: 4.6/5

7. FreshBooks

FreshBooks is a user-friendly tool that allows businesses to track expenses easily by syncing with credit cards and bank accounts. However, it lacks in-app reimbursement, which is a downside for some users.

- Pros: Multi-currency support, recurring expenses, easy to use

- Cons: No in-app reimbursement, extra fees for additional team members

- Free Trial: 30 days

- User Rating: 4.4/5

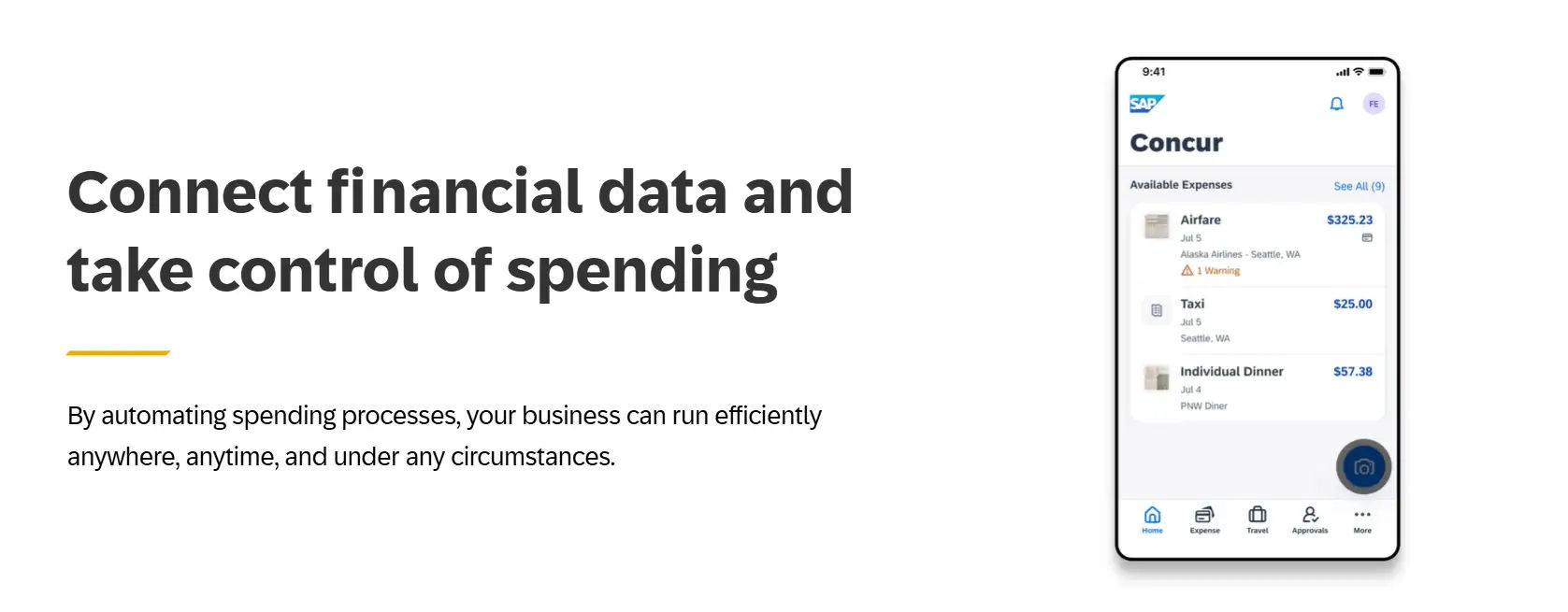

8. SAP Concur Expense

SAP Concur Expense offers a high level of customization, making it a great fit for businesses with dynamic expense tracking needs. It provides automated reporting and allows expenses to be captured even while offline.

- Pros: Expense capture offline, in-app reimbursement

- Cons: Limited receipt page scanning

- Free Trial: 15 days

- User Rating: 4.4/5

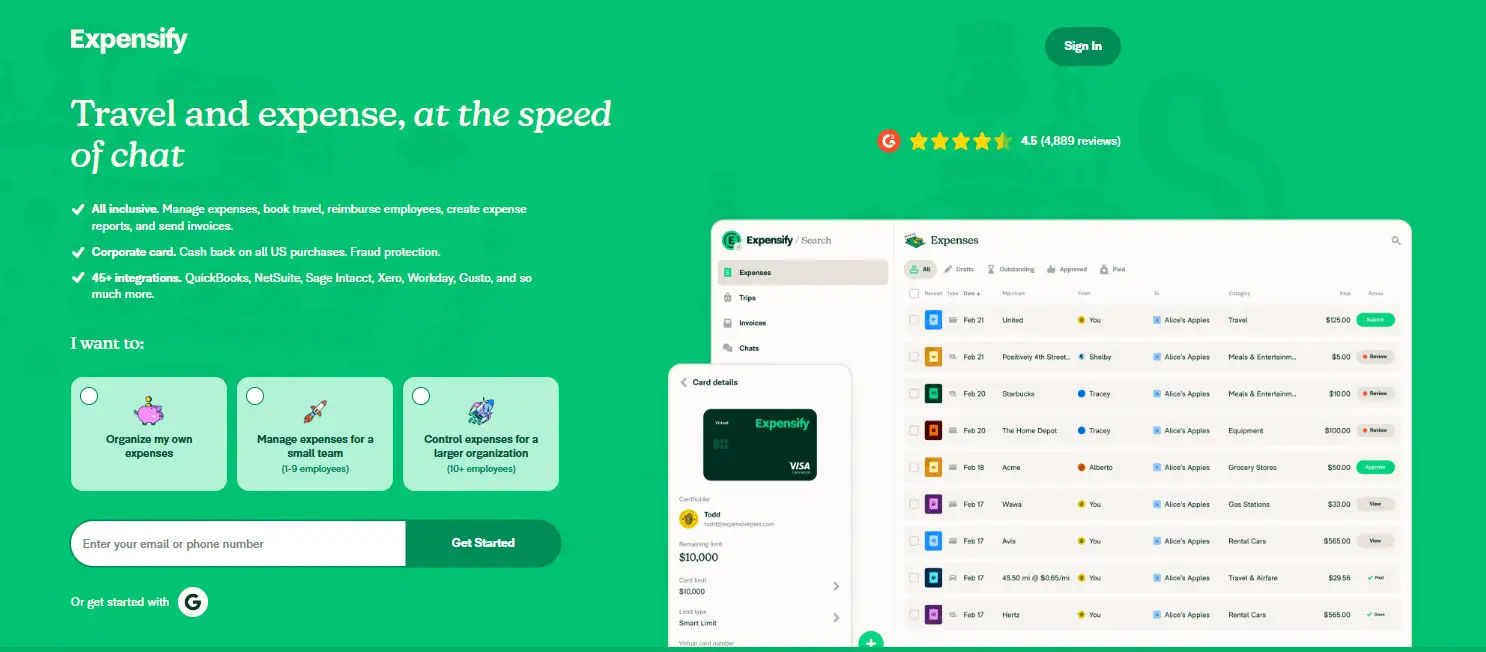

9. Expensify

Expensify is a powerful expense tracking app that allows businesses to scan and track receipts, automatically categorize expenses, and track taxes. Its easy integration with accounting software makes it a favourite among many businesses.

- Pros: Discounts with Expensify card, separate business plans, tax tracking

- Cons: Expensive without the Expensify card, limited to 25 auto-scans per month in free plan

- Free Trial: Up to 6 weeks

- User Rating: 4.3/5

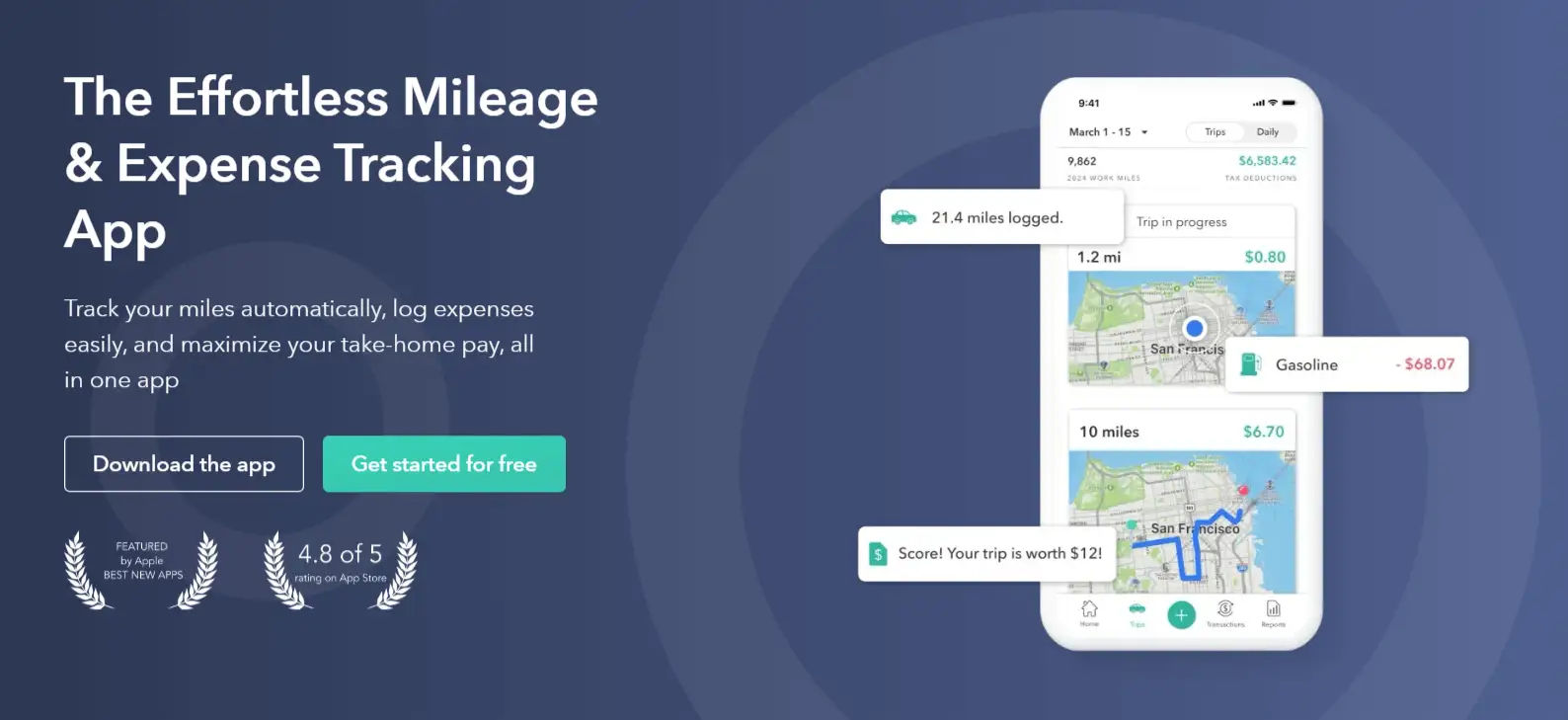

10. Everlance

Everlance is perfect for businesses that deal with frequent travel and mileage. The app offers unlimited receipt uploads and automatically tracks purchases made with credit cards. It also helps with tax deductions by identifying deductible expenses.

- Pros: Unlimited receipt uploads, unlimited users

- Cons: Focused primarily on mileage tracking, USD-only support

- Free Trial: 7 days

- User Rating: 4.2/5

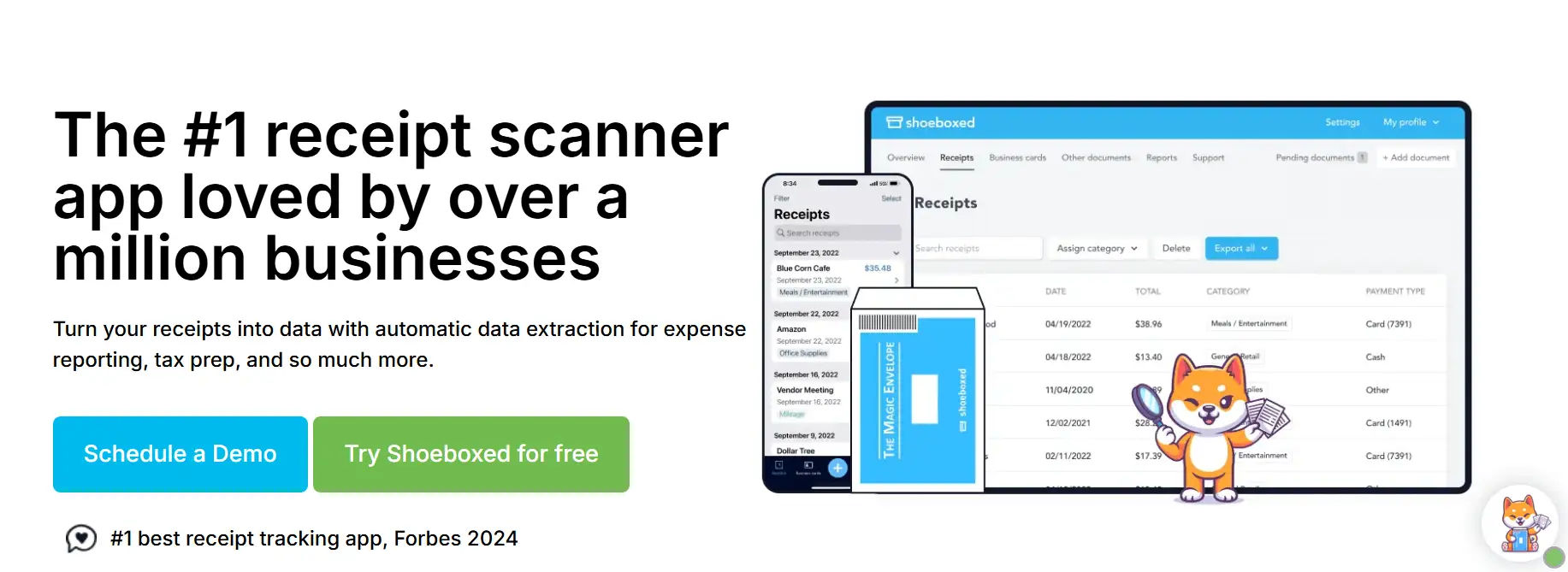

11. Shoeboxed

Shoeboxed simplifies the process of scanning and digitizing receipts. By sending your receipts in an envelope, the app scans and categorizes them for easy access. It’s an excellent choice for those who deal with physical receipts often.

- Pros: Unlimited file storage, human-verified data

- Cons: No in-app reimbursement, limits on digital/paper receipts per month

- Free Trial: 30 days

- User Rating: 4.1/5

12. Xero

Xero is a fantastic option for small businesses that need a customized financial management tool. With extensive integrations and a focus on simplicity, it’s ideal for companies that require more than just expense tracking.

- Pros: Great for small businesses, comprehensive financial management

- Cons: Limited invoices and bills on lower tier plans

- Free Trial: 30 days

- User Rating: 4.4/5

13. Rippling

Rippling is a workforce management platform that integrates HR, IT, and finance. It offers a centralized platform to manage expenses along with payroll and employee benefits, making it a great choice for larger teams.

- Pros: Automated workflows, self-service employee portals

- Cons: Steep learning curve, time-consuming setup

- Free Trial: Demo available

- User Rating: 4.8/5

14. Airbase

Airbase is an accounts payable automation platform that simplifies expense management and corporate card spending. It offers real-time visibility into company spending, reducing manual processes.

- Pros: Real-time visibility, seamless integrations

- Cons: Steep learning curve, unclear pricing

- Free Trial: Free plan available

- User Rating: 4.8/5

15. Navan

Navan combines travel and expense management into one platform, offering unified oversight of both aspects. It provides real-time financial insights and is user-friendly, making it a top choice for businesses with frequent travel expenses.

- Pros: Real-time spending visibility, travel and expense management integration

- Cons: Non-transparent pricing

- Free Trial: Free plan available

- User Rating: 4.7/5

16. Spendesk

_DC_YrXUxP.webp)

Spendesk allows businesses to control expenses in real-time through credit card integration and approval workflows. It offers in-depth analytics tools and is ideal for managing business spending.

- Pros: Strong analytics tools, accounting integrations

- Cons: Higher price for advanced features

- Free Trial: 7 days

- User Rating: 4.6/5

17. Tallyfy

Tallyfy is an expense management software that focuses on automating workflows. This is ideal for businesses looking to streamline approval processes while keeping track of expenses.

- Pros: Customizable workflows, easy reporting

- Cons: Limited integrations

- Free Trial: 14 days

- User Rating: 4.5/5

18. Fyle

Fyle offers AI-powered expense categorization and one-click receipt scanning. It also integrates with major accounting tools and offers robust tax tracking features.

- Pros: Multiple integrations, tax tracking

- Cons: Expensive without premium plans

- Free Trial: 14 days

- User Rating: 4.7/5

19. Payhawk

Payhawk automates accounts payable processes and offers detailed spend reports. It is particularly useful for corporate teams and businesses looking to streamline their financial operations.

- Pros: Seamless integrations, real-time tracking

- Cons: No free plan

- Free Trial: Demo available

- User Rating: 4.5/5

20. Webexpenses

Web expenses offers a user-friendly mobile app for tracking and managing business expenses. It specializes in travel expense tracking and provides comprehensive mileage tracking.

- Pros: Easy-to-use interface, comprehensive mileage tracking

- Cons: Requires at least three active users, lengthy setup

- Free Trial: 14 days

- User Rating: 4.4/5

Why Expense Tracker 365 is the Best Expense Tracking and Reimbursement App for Small Businesses

When it comes to managing expenses and reimbursements small businesses face unique challenges. They often have limited resources and need tools that are not only efficient but also affordable. Expense Tracker 365 stands out as the best expense tracking and reimbursement app for small businesses, thanks to its user-friendly features, seamless integrations, and flexibility. Here’s why Expense Tracker 365 is the go-to choice for small businesses:

Comprehensive Expense Management

Expense Tracker 365 simplifies the entire process of managing business expenses. Whether it’s tracking daily purchases, categorizing expenses, or analysing spending patterns, the app covers it all. You can automatically import expenses from bank accounts, credit cards, and other financial sources, making it easy to keep a real-time record of your expenses. This comprehensive tracking ensures that small businesses don’t miss any important financial detail.

Easy-to-Use Interface

For small businesses that may not have a dedicated accounting team, the ease of use is a key factor in choosing the right app. Expense Tracker 365 offers a clean and intuitive interface, making it simple for anyone, even with minimal accounting knowledge, to get started. The app is designed to be user-friendly, reducing the learning curve and allowing business owners to focus on what matters most running their business.

Seamless Reimbursement Process

One of the standout features of Expense Tracker 365 is its seamless reimbursement process. Business owners and employees can submit expenses quickly, and the app allows for easy approvals. Reimbursements are processed efficiently, and businesses can automate the approval process based on preset rules. This automation saves valuable time, reducing the manual work involved in expense management.

Multi-Currency Support

As small businesses often deal with international suppliers or clients, Expense Tracker 365 is a game-changer and pricing plans are starting from just $49. The app supports global transactions, making it easy for businesses with an international footprint to track expenses without worrying about currency conversions. This feature ensures that all expenses, no matter where they occur, are accurately recorded.

Tax Deduction Tracking

Expense Tracker 365 helps small businesses maximize their tax deductions by tracking deductible expenses in real time. This feature is crucial for businesses that want to ensure they are taking full advantage of available tax savings. The app makes tax season less stressful by keeping all receipts, expenses, and deductions neatly organized in one place, ready for easy reference.

Integration with Accounting Tools

Integrating with accounting software is essential for businesses that want to streamline their finances. Expense Tracker 365 easily integrates with popular accounting platforms like QuickBooks enabling seamless synchronization of data. This ensures that expense reports are automatically updated in your accounting system, saving time and reducing errors.

Customizable Reporting

Expense Tracker 365 offers highly customizable reporting features, allowing businesses to generate reports that fit their specific needs. You can track expenses by category, department, employee, or project. These detailed reports help business owners gain deeper insights into where their money is going, which is essential for budgeting and financial planning.

Affordable and Scalable

Small businesses need to keep costs low without compromising on quality. Expense Tracker 365 offers an affordable pricing structure that provides excellent value for the features it offers. As your business grows, the app can easily scale to meet your expanding needs, ensuring that it remains an asset as your business evolves.

Cloud-Based Access

Being a cloud-based solution, Expense Tracker 365 allows small businesses to access their financial data from anywhere, at any time. Whether you’re in the office or on the go, you can monitor expenses and approve reimbursements with ease. The cloud-based system also ensures that all data is backed up and securely stored, reducing the risk of losing important financial information.

Excellent Customer Support

Expense Tracker 365 provides exceptional customer support, which is critical for small businesses that may not have dedicated IT team. Whether you need help setting up the app or troubleshooting issues, their support team is readily available to assist you, ensuring that your business runs smoothly without any unnecessary delays.

Conclusion

To wrap up today’s post on best expense tracking and reimbursement app for small business in 2025 it’s evident that keeping a close eye on expenses is crucial for staying within budget and driving cost savings. The best expense trackers come with features like income and expense tracking, sales monitoring, managing vendors and contractors, organizing receipts and taxes, and automating workflows. Expense Tracker 365 truly excels in this area, offering a comprehensive solution that helps businesses effortlessly stay organized, save time, and make better financial choices. It’s a powerful tool for those who want to streamline their finances and keep everything running smoothly.

Frequently Asked Questions

What is a good app to keep track of business expenses?

A highly recommended app to track business expenses is Expense Tracker 365. It provides an all-in-one solution for:

- Tracking income and expenses

- Managing contractors and vendors

- Organizing receipts and taxes

- Automating workflows

It’s simple to use, offers powerful features, and helps businesses maintain financial clarity and efficiency.

How do small businesses keep track of expenses?

Small businesses typically use the following methods to track expenses:

- Manual tracking: Many businesses use spreadsheets (Excel or Google Sheets) to manually log expenses.

- Accounting software: Tools like QuickBooks, FreshBooks, and Xero automate expense tracking and offer detailed reports.

- Expense tracking apps: Apps like Expense Tracker 365, Zoho Expense, and Wave help streamline the process, making it easier to categorize and track every expense in real-time.

These methods ensure businesses stay on top of their spending and make informed financial decisions.

Which app is best for expense trackers?

The best app for expense tracking depends on the business’s needs. Here are a few top options:

- Expense Tracker 365: An all-in-one solution with features like expense categorization, receipt scanning, and budgeting.

- QuickBooks: Great for businesses that need advanced accounting features along with expense tracking.

- Zoho Expense: Ideal for businesses looking for automated expense reporting and approval workflows.

How can businesses track both personal and business expenses separately?

To keep personal and business expenses separate, businesses can use the following strategies:

- Expense tracking apps: Many apps like Expense Tracker 365 allow users to create multiple categories or accounts (e.g., personal and business) to easily distinguish between the two.

- Dedicated accounts: Businesses often open a separate bank account and credit card for business expenses to ensure they are not mixed with personal finances.

- Budgeting software: Tools like YNAB (You Need A Budget) or Mint can also help set up separate budgets for personal and business expenses to maintain clarity.

What are the benefits of using an expense tracking app?

Using an expense tracking app provides several key benefits:

- Time-saving automation: Apps like Expense Tracker 365 automate categorizing and recording expenses, reducing manual work.

- Real-time insights: Track spending as it happens and gain immediate visibility into your financial health.

- Tax preparation: Keep organized records of all expenses, making tax filing easier and potentially leading to greater tax savings.

- Budgeting and forecasting: Set spending limits, track progress, and adjust budgets to make smarter financial decisions.

_Rapo0hRMBy.png)